stamp duty act malaysia

For example a 1 million purchase can attract stamp duty as high as 55000. Stamp duty exemption on loanfinancing agreements executed from 1 January 2022 to 31 December 2026 between MSMEs and investors for funds raised on a peer-to-peer P2P platform registered and recognised by the Securities Commission Malaysia.

Proposed Ad Valorem Stamp Duty To Be Paid When Contract Signed Publication By Hhq Law Firm In Kl Malaysia

Yes it is an offence under Section 62 of Stamp Duties Act to evade stamp duty by executing a document where facts and circumstances are not fully and truly set forth.

. Stamp duty exemption on instrument of agreement for a loan or financing in relation to a Micro Financing. Yonhap news articles produced by building a network covering domestic supplies in various newspapers broadcasting and government departments major institutions major corporations media K-pop K-wave Hallyu Korean Wave Korean pop Korean pop culture Korean culture Korean idol Korean movies Internet media and international agreements of the Republic of. The more expensive the home the more stamp duty is.

Tenancy agreement between 1 to 3 years RM2 for every RM250 of the annual rent above RM2400. Stamp duty fees are typically paid by the buyer not the seller. ACT payable within 28 days of settlement purchasers must pay stamp duty within 14 days of receiving a Notice of Assessment from Access Canberra.

Stamp duty in India is governed by two legislations ie a stamp Act legislated by the Parliament and a stamp Act legislated by the state legislature. Calculate now and get free quotation. Buyers will be sent this in an email sometime.

Formally a string is a finite ordered sequence of characters such as letters digits or spaces. Individuality or self-hood is the state or quality of being an individual. The stamp duty is free if.

1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. When do you have to pay stamp duty. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia.

Massachusetts woman accused of weaponizing bees to stop officers trying to enforce eviction. Get the latest news and follow the coverage of breaking news events local news weird news national and global politics and more from the worlds top trusted media outlets. Particularly in the case of humans of being a person unique from other people and possessing ones own needs or goals rights and responsibilitiesThe concept of an individual features in diverse fields including biology law and philosophy.

An individual is that which exists as a distinct entity. Stamp duty is the governments charge levied on different property transactions. The stamp duty is free if the annual rental is below RM2400.

Just as the stamp duty rate varies from state to state so does the timeframe in which people need to pay it. A revenue stamp tax stamp duty stamp or fiscal stamp is a usually adhesive label used to designate collected taxes or fees on documents tobacco alcoholic drinks drugs and medicines playing cards hunting licenses firearm registration and many other thingsTypically businesses purchase the stamps from the government thereby paying the tax and attach them to taxed. Mortgage loan basics Basic concepts and legal regulation.

The empty string is the special case where the sequence has length zero so there are no symbols in the string. Home Malaysia Law Firm Malaysia Law Statutes Legal Fee Stamp Duty for Sale Purchase Agreement Loan. Your conveyancer or legal adviser can do the paperwork.

The Stamp Act of 1712 was an act passed in the United Kingdom on 1 August 1712 to create a new tax on publishers particularly of newspapers. And if the Tenancy Agreement has been signed for more than 3 years the. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

The law on stamping and registration. Official City of Calgary local government Twitter account. Stamp duty is a tax on legal documents in Malaysia.

On a 500000 house first home buyers wont pay any stamp duty in Victoria New South Wales or Queensland. Income tax generally is computed as the product of a tax rate times taxable income. Other than newspapers it required that all pamphlets legal documents.

The initial assessed rate of tax was one penny per whole newspaper sheet a halfpenny for a half sheet and one shilling per advertisement contained within. Stamp duty on rental agreements. From the 1st April 2016 anyone purchasing a property in addition to their main home will pay an additional 3 SDLT for the first 125000 and 5 instead of 2 on the portion between 125001 and 250000 and 8 on the amount above 250001.

Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400. Follow The Latest News From The World Of Agriculture And Farming With Timely Updates About Crop Prices Farm Equipment Much More sectionkeywordsagri business newsagribusinessagriculture. What is stamp duty.

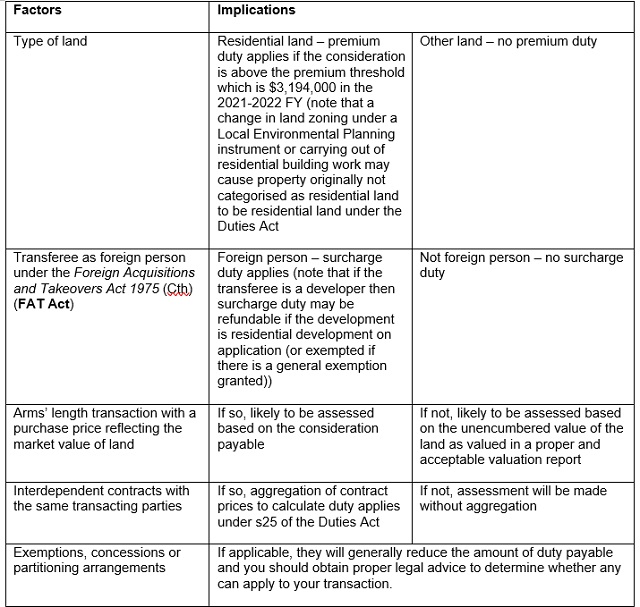

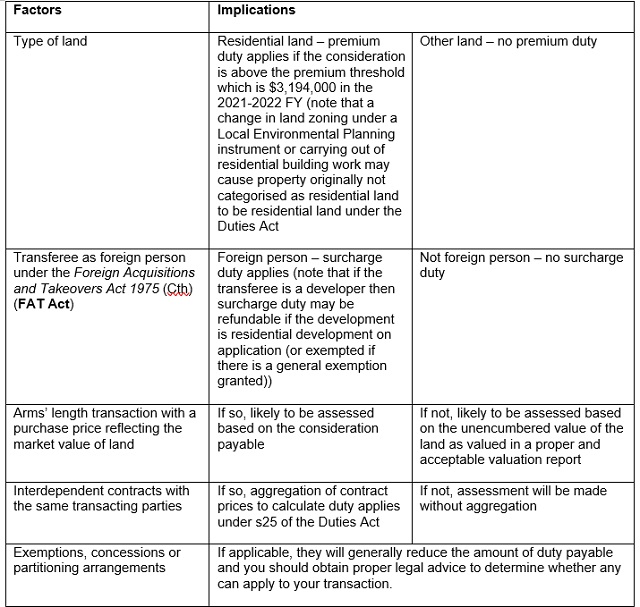

Stamp duty is a tax payable to the relevant state or territory when you purchase or acquire an interest in a commercial property. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. The stamp duty for a tenancy agreement in Malaysia is calculated as the following.

Income Tax Income Tax is a tax imposed on individuals or entities taxpayers that varies with respective income or profits taxable income. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement. Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites.

What are the changes to Stamp Duty when buying a UK second home or buy to let in the UK from 1st April 2016. Any person guilty of such an offence shall be liable on conviction to a fine not exceeding 10000 or to imprisonment for a term not exceeding 3 years or to both. Central Excise Act 1944 which imposes a duty of excise on goods manufactured or produced in India.

Some examples of documents where stamp duties are applicable include your Tenancy Agreement Instrument of Transfer and Loan Agreements. In fact its one of the main sources of government revenue. Generally the stamp duty is paid by the buyer in some cases the buyer and seller decide to split the stamp duty as per an earlier signed agreement.

Also read all about income tax provisions for TDS on rent. For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is RM2 for every RM250 of the annual rent in excess of RM2400. Several states offer stamp duty exemptions and concessions to first-home buyers.

Stamp duty is payable under Section 3 of the Indian Stamp Act 1899. Stamp duty is generally payable at the time of purchase or very soon after. Keep up with City news services programs events and more.

The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law. Get business latest news breaking news latest updates live news top headlines latest finance news breaking business news top news of the day and more at Business Standard.

Perceptions Of Individual Taxpayers Towards The Intention To Pay Stamp Duty Tax To Zanzibar Revenue Board

All You Need To Know About The Calculation Of Stamp Duty On Different Instruments Ipleaders

Firs Clarifies Amendments To The Stamp Duties Act

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Section 15 Of Rosli Dahlan Saravana Partnership Rds Facebook

Mot And Stamp Duty In Malaysia Maxland Real Estate Agency

Stamp Act 1949 Laws Of Malaysia Online Version Of Updated Text Of Reprint Act 378 Stamp Act 1949 Studocu

Ws Genesis E Stamping Services

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Rental Agreement Stamp Duty Malaysia Speedhome

Stamp Duty Exemption In Malaysia Jr Ng Chin Jc Law

Stamp Duty Remission Granted To Malaysian Taxpayer International Tax Review

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

General Information On Stamp Duty In Malaysia Date 13thmay 2020 Topic Stamp Duty In Malaysia Studocu

Stamp Act 1949 Laws Of Malaysia Online Version Of Updated Text Of Reprint Act 378 Stamp Act 1949 Studocu

Stamp Duty A Summary On The Existing Framework And Proposed Future Changes Real Estate Australia

0 Response to "stamp duty act malaysia"

Post a Comment